We have already learnt about Monte Carlo method in the previous post - Monte Carlo. In this post I am going to discuss on how can that method be used for determining the maximum risk involved in investing to a stock.

#import libraries

import pandas as pd

from pandas import Series,DataFrame

import numpy as np

# For Visualization

import matplotlib.pyplot as plt

import seaborn as sns

sns.set_style('whitegrid')

%matplotlib inline

# For reading stock data from yahoo

import pandas_datareader as pdr

from datetime import datetime

from __future__ import division

import pandas_datareader.data as web

tech_list = ['AAPL','GOOG','MSFT','AMZN']

# Set up End and Start times for data grab

end = datetime.now()

start = datetime(end.year - 1,end.month,end.day)

for stock in tech_list:

globals()[stock] = web.DataReader(stock,'yahoo',start,end)

#Descriptive & Exploratory analysis

AAPL.describe()

| Open | High | Low | Close | Volume | Adj Close | |

|---|---|---|---|---|---|---|

| count | 252.000000 | 252.000000 | 252.000000 | 252.000000 | 2.520000e+02 | 252.000000 |

| mean | 115.796667 | 116.627698 | 115.155357 | 115.973928 | 3.193192e+07 | 115.217969 |

| std | 15.948756 | 15.931637 | 15.978002 | 15.994669 | 1.433693e+07 | 16.482845 |

| min | 90.000000 | 91.669998 | 89.470001 | 90.339996 | 1.147590e+07 | 89.008370 |

| 25% | 104.767498 | 105.959999 | 104.060001 | 105.499998 | 2.352475e+07 | 104.394087 |

| 50% | 113.225003 | 114.055001 | 112.389999 | 113.069999 | 2.818830e+07 | 112.006823 |

| 75% | 128.062502 | 129.665000 | 127.875000 | 128.832501 | 3.588788e+07 | 128.276348 |

| max | 147.539993 | 148.089996 | 146.839996 | 147.509995 | 1.119850e+08 | 147.509995 |

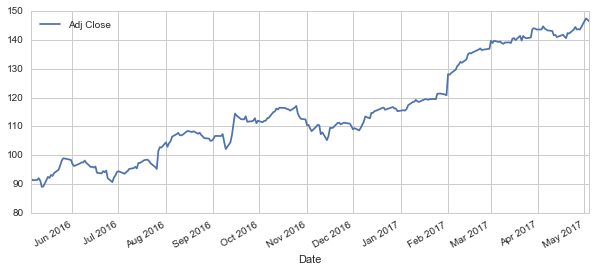

# Let's see historical view of the closing price for the last one year

AAPL['Adj Close'].plot(legend=True,figsize=(10,4))

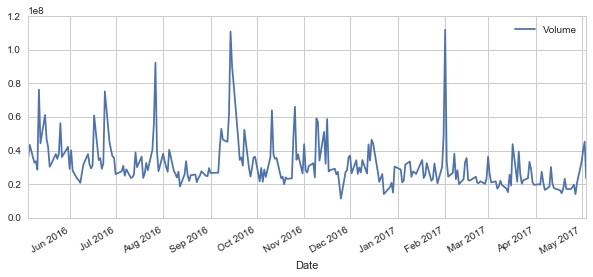

# Now let's plot the total volume of stock being traded each day over the past year

AAPL['Volume'].plot(legend=True,figsize=(10,4))

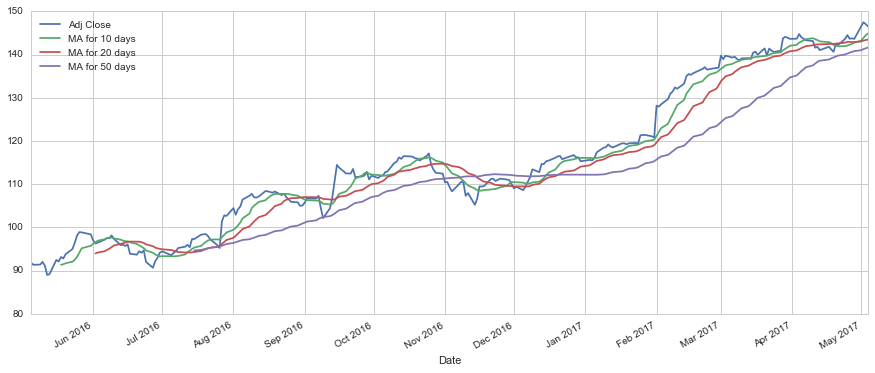

#Calculate and plot the simple moving average (SMA) for upto 10, 20 and 50 days

moving_avg_day = [10,20,50]

for ma in moving_avg_day:

column_name = "MA for %s days" % (str(ma))

AAPL[column_name] =pd.rolling_mean(AAPL['Adj Close'],ma)

AAPL[['Adj Close','MA for 10 days','MA for 20 days','MA for 50 days']].plot(subplots=False,figsize=(15,6))

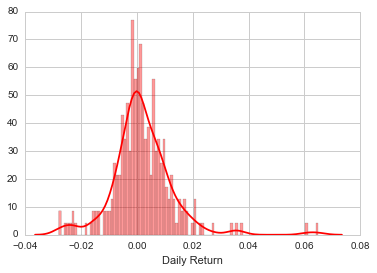

#Now lets analyse the Daily Return Analysis as our first step to determing the volatility of the stock prices

# We'll use pct_change to find the percent change for each day

AAPL['Daily Return'] = AAPL['Adj Close'].pct_change()

# Then we'll plot the daily return percentage

AAPL['Daily Return'].plot(figsize=(12,4),legend=True,linestyle='--',marker='o')

#Average daily return

#Using dropna to eliminate NaN values

sns.distplot(AAPL['Daily Return'].dropna(),bins=100,color='red')

#Now lets do a comparative study to analyze the returns of all the stocks in our list

# Grab all the closing prices for the tech stocks into one new DataFrame

closing_df = web.DataReader(['AAPL','GOOG','MSFT','AMZN'],'yahoo',start,end)['Adj Close']

# Let's take a quick look

closing_df.head()

| AAPL | AMZN | GOOG | MSFT | |

|---|---|---|---|---|

| Date | ||||

| 2016-05-05 | 91.865625 | 659.090027 | 701.429993 | 48.660218 |

| 2016-05-06 | 91.353293 | 673.950012 | 711.119995 | 49.098687 |

| 2016-05-09 | 91.422261 | 679.750000 | 712.900024 | 48.786888 |

| 2016-05-10 | 92.042972 | 703.070007 | 723.179993 | 49.712543 |

| 2016-05-11 | 91.146389 | 713.229980 | 715.289978 | 49.741774 |

# Make a new DataFrame for storing stock daily return

tech_rets = closing_df.pct_change()

# Using joinplot to compare the daily returns of Google and Microsoft

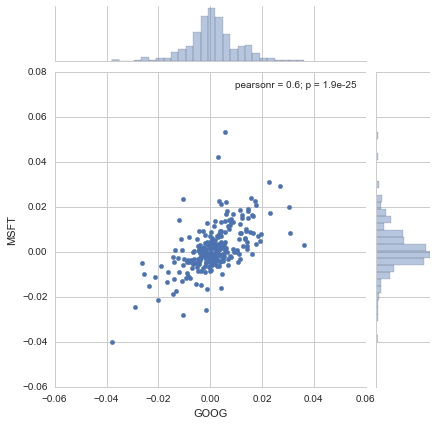

sns.jointplot('GOOG','MSFT',tech_rets,kind='scatter')

<seaborn.axisgrid.JointGrid at 0x24cfc1bf080>

The correlation coefficient of 0.6 indicates a strong correlation between the daily return values of Microsoft and Google. This inplies that if google’s stock value increases, microsoft’s stock value and hence daily return increases and vice versa. This analysis can further be extended by first segmentation of stock based on industry and then further analysis can be done to determine the choice of stock within that industry.

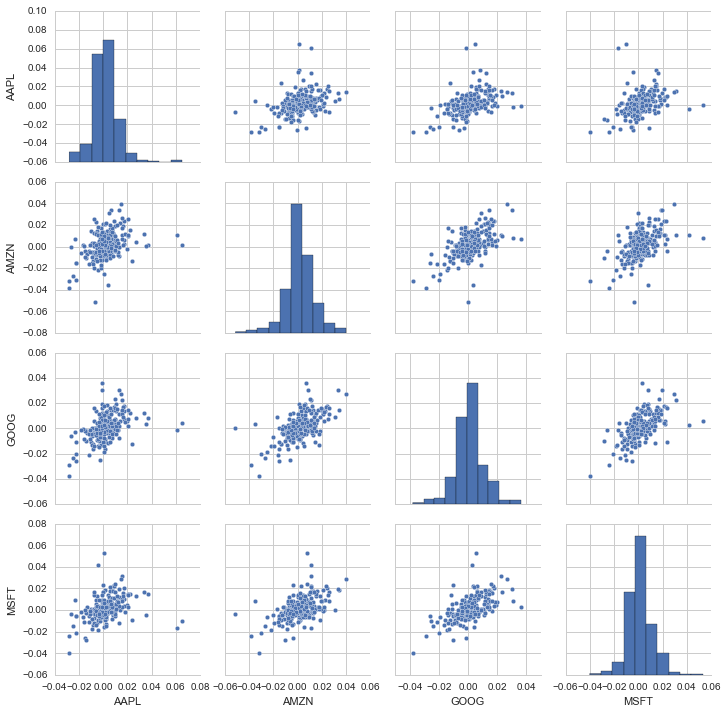

# We can also simply call pairplot on our DataFrame for visual analysis of all the comparisons

sns.pairplot(tech_rets.dropna())

<seaborn.axisgrid.PairGrid at 0x24cfc6a4dd8>

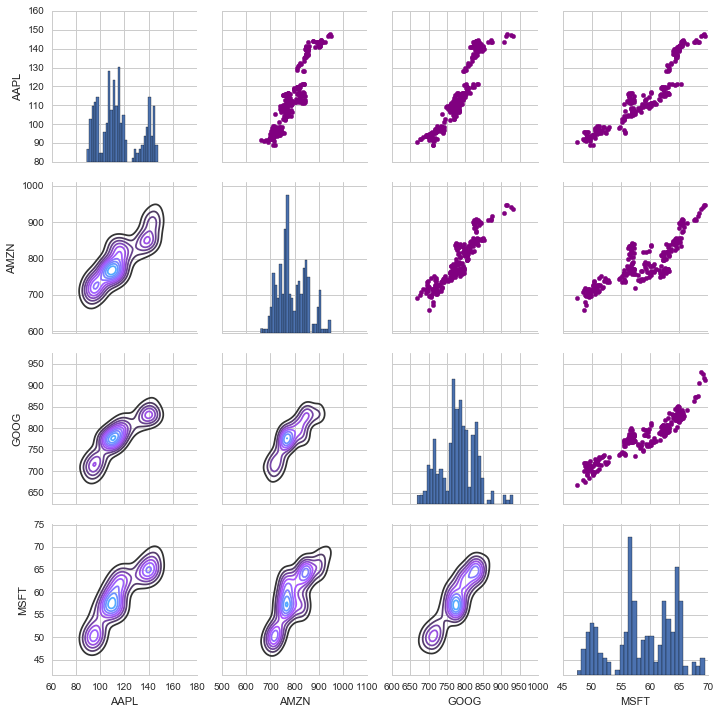

#Another analysis on the closing prices for each stock and their individual comparisons

# Call PairPLot on the DataFrame

close_fig = sns.PairGrid(closing_df)

# Using map_upper we can specify what the upper triangle will look like.

close_fig.map_upper(plt.scatter,color='purple')

# We can also define the lower triangle in the figure, including the plot type (kde) or the color map (BluePurple)

close_fig.map_lower(sns.kdeplot,cmap='cool_d')

# Finally we'll define the diagonal as a series of histogram plots of the closing price

close_fig.map_diag(plt.hist,bins=30)

<seaborn.axisgrid.PairGrid at 0x24cfdf8a160>

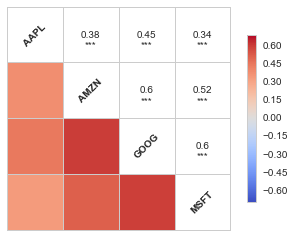

#For a quick look at the correlation analysis for all stocks, we can plot for the daily returns using corrplot

from seaborn.linearmodels import corrplot as cor

cor(tech_rets.dropna(),annot=True)

C:\Users\saj16\Anaconda3\lib\site-packages\seaborn\linearmodels.py:1290: UserWarning: The `corrplot` function has been deprecated in favor of `heatmap` and will be removed in a forthcoming release. Please update your code.

warnings.warn(("The `corrplot` function has been deprecated in favor "

C:\Users\saj16\Anaconda3\lib\site-packages\seaborn\linearmodels.py:1356: UserWarning: The `symmatplot` function has been deprecated in favor of `heatmap` and will be removed in a forthcoming release. Please update your code.

warnings.warn(("The `symmatplot` function has been deprecated in favor "

<matplotlib.axes._subplots.AxesSubplot at 0x24cfff485f8>

Risk Analysis: Bootstraping method, Monte Carlo method

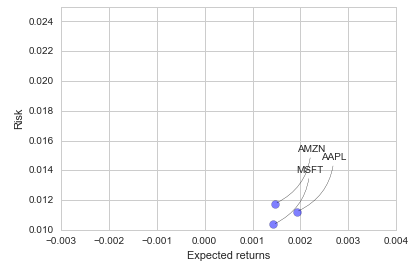

#It is important to note the risk involved with the expected return for each stock visually before starting the analysis

rets = tech_rets.dropna()

area = np.pi*20

plt.scatter(rets.mean(), rets.std(),alpha = 0.5,s =area)

# Setting the x and y limits & plt axis titles

plt.ylim([0.01,0.025])

plt.xlim([-0.003,0.004])

plt.xlabel('Expected returns')

plt.ylabel('Risk')

for label, x, y in zip(rets.columns, rets.mean(), rets.std()):

plt.annotate(

label,

xy = (x, y), xytext = (50, 50),

textcoords = 'offset points', ha = 'right', va = 'bottom',

arrowprops = dict(arrowstyle = '-', connectionstyle = 'arc3,rad=-0.3'))

As seen in the above plot the less the expected return, lesser the risk involved. Next lets determine the “Value at Risk”, that is the worst daily loss that can be encountered with 95 % Confidence.

rets['AAPL'].quantile(0.05)

-0.014682686093512198

The 0.05 empirical quantile of daily returns is at -0.015. That means that with 95% confidence, worst daily loss will not exceed 1.5%. If we have a 1 million dollar investment, our one day 5% VaR is 0.015 * 1,000,000 = $15,000.

Value at Risk using the Monte Carlo method

Using the Monte Carlo to run many trials with random market conditions, then we’ll calculate portfolio losses for each trial. After this, we’ll use the aggregation of all these simulations to establish how risky the stock is. Let’s start with a brief explanation of what we’re going to do:

We will use the geometric Brownian motion (GBM), which is technically known as a Markov process. This means that the stock price follows a random walk and is consistent with (at the very least) the weak form of the efficient market hypothesis (EMH): past price information is already incorporated and the next price movement is “conditionally independent” of past price movements. This means that the past information on the price of a stock is independent of where the stock price will be in the future, basically meaning, you can’t perfectly predict the future solely based on the previous price of a stock.

The equation for geometric Browninan motion is given by the following equation: \(\frac{\Delta{S}}{S}= {\mu \Delta{t}}+{\sigma \epsilon \sqrt{\Delta{t}}}\)

Where S is the stock price, mu is the expected return (which we calculated earlier),sigma is the standard deviation of the returns, t is time, and epsilon is the random variable. We can mulitply both sides by the stock price (S) to rearrange the formula and solve for the stock price. \({\Delta{S}}= S({\mu \Delta{t}}+{\sigma \epsilon \sqrt{\Delta{t}}})\)

Now we see that the change in the stock price is the current stock price multiplied by two terms. The first term is known as “drift”, which is the average daily return multiplied by the change of time. The second term is known as “shock”, for each tiem period the stock will “drift” and then experience a “shock” which will randomly push the stock price up or down. By simulating this series of steps of drift and shock thousands of times, we can begin to do a simulation of where we might expect the stock price to be.

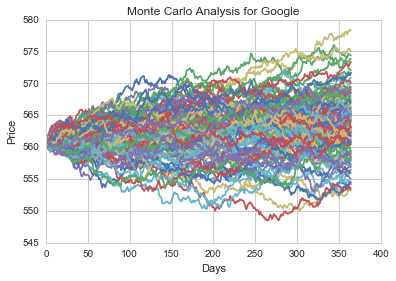

# Set up time horizon and delta values

days = 365

dt = 1/days

# Calculate mu (drift) from the expected return data we got for AAPL

mu = rets.mean()['GOOG']

# Calculate volatility of the stock from the std() of the average return

sigma = rets.std()['GOOG']

def stock_monte_carlo(start_price,days,mu,sigma):

''' This function takes in starting stock price, days of simulation, mu, sigma and returns simulated price array'''

price = np.zeros(days)

price[0] = start_price

shock = np.zeros(days)

drift = np.zeros(days)

# Calculating and returning price array for number of days

for x in range(1,days):

shock[x] = np.random.normal(loc=mu * dt, scale=sigma * np.sqrt(dt))

drift[x] = mu * dt

price[x] = price[x-1] + (price[x-1] * (drift[x] + shock[x]))

return price

# Get start price from GOOG.head()

start_price = 560.85

simulations = np.zeros(100)

for run in range(100):

simulations[run] = stock_monte_carlo(start_price,days,mu,sigma)[days-1]

plt.plot(stock_monte_carlo(start_price,days,mu,sigma))

plt.xlabel("Days")

plt.ylabel("Price")

plt.title('Monte Carlo Analysis for Google')

<matplotlib.text.Text at 0x24c805d4278>

# Now we'lll define q as the 1% empirical qunatile, this basically means that 99% of the values should fall between here

q = np.percentile(simulations, 1)

# Now let's plot the distribution of the end prices

plt.hist(simulations,bins=200)

# Using plt.figtext to fill in some additional information onto the plot

# Starting Price

plt.figtext(0.6, 0.8, s="Start price: $%.2f" %start_price)

# Mean ending price

plt.figtext(0.6, 0.7, "Mean final price: $%.2f" % simulations.mean())

# Variance of the price (within 99% confidence interval)

plt.figtext(0.6, 0.6, "VaR(0.99): $%.2f" % (start_price - q,))

# Display 1% quantile

plt.figtext(0.15, 0.6, "q(0.99): $%.2f" % q)

# Plot a line at the 1% quantile result

plt.axvline(x=q, linewidth=4, color='r')

# Title

plt.title(u"Final price distribution for Google Stock after %s days" % days, weight='bold');

This basically means that for every initial stock you purchase there is about $13.61 at risk 1% of the time as predicted by Monte Carlo Simulation.